XRP Whales Accumulate: A Bullish Trend on the Horizon?

XRP, the digital asset developed by Ripple, has been experiencing fluctuating price movements in recent months. Despite a phase of decline, large cryptocurrency holders, known as whales, have been accumulating massive amounts of XRP, signaling a potential bullish trend. With historical trends indicating possible future growth, investors are keeping a close eye on market movements and technical indicators such as the Relative Strength Index (RSI). This article explores the implications of whale accumulation, market sentiment, and XRP’s potential price trajectory.

Understanding the Role of Whales in the Crypto Market

Whales in the cryptocurrency market refer to investors or entities that hold a significant portion of a digital asset. Their transactions can heavily influence price trends, either by increasing demand through accumulation or triggering sell-offs. Whales are often considered smart money, and their actions provide insights into future market movements.

XRP Whales Accumulate Large Amounts

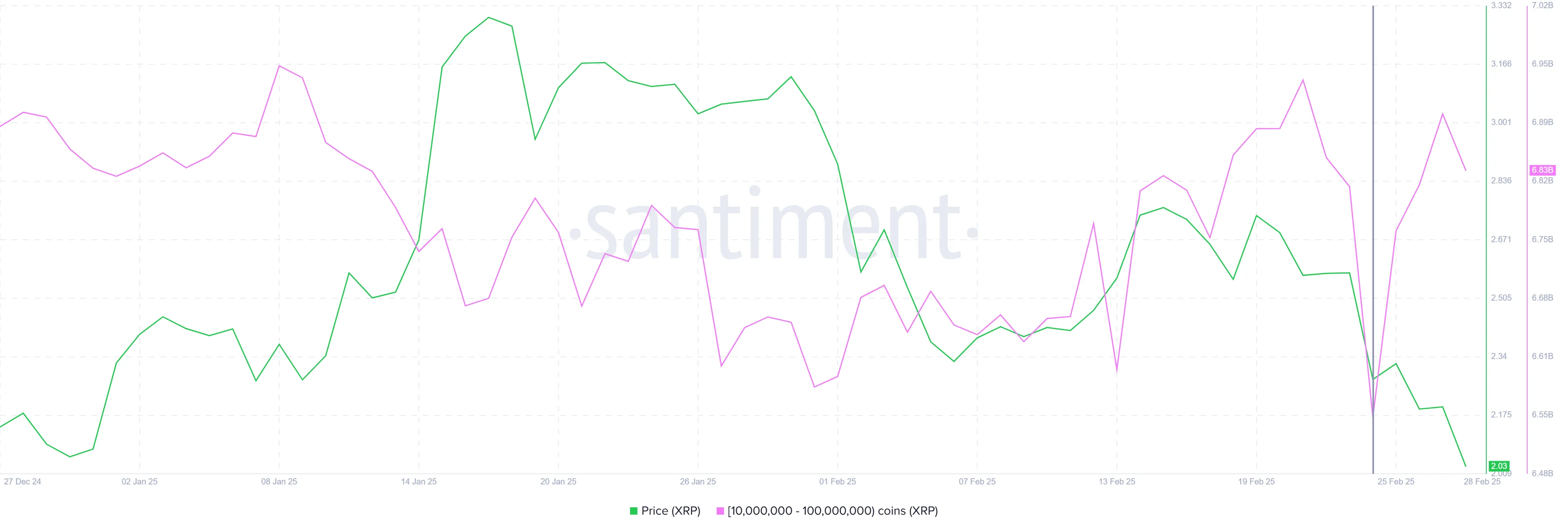

Recent market data has revealed that addresses holding between 10 million and 100 million XRP have collectively acquired over 300 million tokens, amounting to an estimated $609 million. This accumulation suggests a renewed confidence among large holders, as they had previously liquidated assets during periods of high prices. The trend shift from selling at high prices to buying at lower levels points toward a potential bullish rally.

Impact of Whale Accumulation on XRP Price

Whale behavior is a crucial indicator of market sentiment. The current buying trend among XRP whales suggests that the asset is being accumulated at a discount, implying a possible price recovery. Historically, similar accumulation phases have preceded significant price upswings. If the trend follows past patterns, XRP may witness a considerable rally in the coming months.

Technical Analysis of XRP

Technical indicators are essential for understanding market trends. One of the key indicators currently pointing toward a bullish reversal for XRP is the Relative Strength Index (RSI).

XRP RSI Analysis

The RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is used to identify overbought or oversold conditions in the market. Typically, an RSI below 30 indicates that an asset is oversold, suggesting a potential price increase. Conversely, an RSI above 70 suggests an overbought condition, signaling a potential price decline.

For the first time in seven months, XRP’s RSI has dropped to an oversold level. The last time such an occurrence took place, XRP witnessed a 47% price surge. Given this historical precedent, there is a strong possibility that the current RSI positioning will trigger a price rebound.

Potential XRP Price Trajectory

Short-Term Price Movements

At present, XRP is trading around the $2 mark, having faced a 24% decline in the past week. The asset has maintained support above the critical $1.94 level. If it successfully surpasses the $2.33 resistance level, it could establish a new support base, paving the way for further upward movement.

In the short term, breaking past $2.33 would indicate strong bullish momentum, potentially pushing XRP towards the $2.70 range. If buying pressure sustains, the token could even challenge the $2.95 mark.

Long-Term Outlook

If XRP manages to sustain its bullish momentum and surpass key resistance levels, it could reach a price target of $2.98 in the long run. However, market conditions and external factors, including regulatory developments and macroeconomic trends, could influence the pace of this rally.

Market Sentiment and External Factors

Regulatory Developments

XRP’s price movements are often influenced by regulatory actions, particularly the ongoing legal battle between Ripple and the U.S. Securities and Exchange Commission (SEC). A favorable outcome for Ripple could act as a significant catalyst for XRP’s price surge. Conversely, adverse rulings could introduce volatility and uncertainty in the market.

Institutional Interest

Institutional participation in the cryptocurrency market has been increasing, with major financial firms exploring blockchain technology and digital assets. If institutional investors start accumulating XRP, it could further strengthen bullish momentum and enhance the asset’s credibility.

Macro Trends in the Crypto Market

The broader cryptocurrency market’s performance also plays a role in XRP’s price action. Bitcoin and Ethereum often set the tone for the market, and their performance can impact investor sentiment toward altcoins like XRP. If the overall market enters a bullish phase, XRP is likely to benefit from increased investor interest.

Potential Risks and Considerations

While the current market trends suggest a bullish future for XRP, investors must consider potential risks before making financial decisions.

Price Volatility

Cryptocurrency markets are highly volatile, and prices can fluctuate rapidly due to various factors. While historical trends indicate a potential uptrend, unforeseen events could lead to sudden market reversals.

Regulatory Risks

As mentioned earlier, regulatory decisions can significantly impact XRP’s price. Traders and investors should stay informed about legal proceedings and regulatory developments affecting Ripple and the broader crypto market.

Market Manipulation

Whale activities, while informative, can also be manipulative. Large holders have the ability to influence market trends by executing large buy or sell orders, leading to short-term price distortions. Retail investors should exercise caution and not solely rely on whale activity for investment decisions.

External Market Conditions

Global economic trends, inflation rates, and financial policies can affect investor sentiment and capital flows into the cryptocurrency market. A downturn in the global economy could impact digital asset investments, including XRP.

Conclusion: Is a Bull Rally Imminent for XRP?

The recent accumulation of XRP by whales, combined with technical indicators such as RSI positioning, suggests that a bullish trend may be on the horizon. While XRP has faced a temporary decline, historical trends indicate that such corrections often precede significant price rallies.

However, investors should exercise caution and conduct thorough research before making financial decisions. The cryptocurrency market is highly dynamic, and factors such as regulatory developments, institutional interest, and macroeconomic conditions play a crucial role in price movements.

For those considering an investment in XRP, keeping an eye on key resistance levels, market trends, and whale activities could provide valuable insights into potential price trajectories. Whether XRP will reach the projected $2.98 target remains to be seen, but current market signals point toward an optimistic future for the asset.

Despite this, the whale crypt has accumulated large amounts of XRP, which could potentially indicate the conversion of the trend of the price of assets. Historical trends indicate that there could be a bull gathering on the horizon.

XRP whales focus on the bull future

The addresses that are between 10 and 100 million XRPs have added more than 300 million pieces in recent days, which in recent days was $ 609 million. The accumulation occurred while these whales have previously sold their assets when prices were higher.

Now, with a market that has experienced a short but intense phase of the decline, the whales are finally buying. This shows that trust could be back on the XRP ripple side.

Purchases of these whales suggest that courses could recover quickly. In general, whale behavior is a strong indicator of the current feeling of the market. This time shopping in the future tells us the accumulation of profits.

The relative force index (RSI) of the ripple token is currently in the occurrence zone, which is a critical technical signal. It is the first time in seven months when RSI dropped to such a low level. Historically, such a reduction for XRP was reversed. The last time the episode took place, it led to 47 %of the rally.

The current RSI value suggests that XRP may occur and could soon complete its correction. As a result, the lesson should be expected, not a significant increase in the key. If the trend continues, XRP could reach up to $ 2.98.

The course of the token has a new goal in mind

Currently, XRP is negotiated around $ 2, after a fall in prices by 24 % last week. The token is maintained above the level of support of $ 1.94. This could soon exceed $ 2.33 to turn this resistance into support. If the asset comes out of the triumphant movement in this way, it could initiate a bull rally.

If technical indicators still indicate the overthrow of the bull’s overthrow, the XRP could approach $ 2.70. Overcoming this resistance would facilitate the task of the token to $ 2.95.

However, if XRP does not exceed $ 2.33 and continues to consolidate at a lower level, it could stagnate between $ 1.94 and $ 2.33. This would invalidate any ascending perspective in delaying a possible recovery.

Notification of irresponsibility

Notice of non -response: In accordance with the Trust project Directives, this article for price analysis is intended only for information purposes and must not be considered financial or investment advice. Beincrypto undertakes to provide accurate and impartial information, but market conditions may change without prior notice. Always carry out your own research before making any financial decision and consult a professional.